For years, asset tracking systems have operated with an unspoken asterisk. Every fleet manager, every logistics coordinator, every operator of heavy equipment knew the truth: once an asset left the comfort of a cellular footprint, you were essentially blind. Some days the blackout lasted an hour, some days a week. Everyone called it “normal.”

That era is quietly ending. The commercial rollout of Globalstar’s RM200M two-way module is more than a product announcement — it is a marker of a deeper shift. The IoT world is moving from “good enough when in range” to “always connected, wherever the asset travels.” The RM200M is a new addition to the low-cost, low-power modules that are making this ambition realistic at scale.

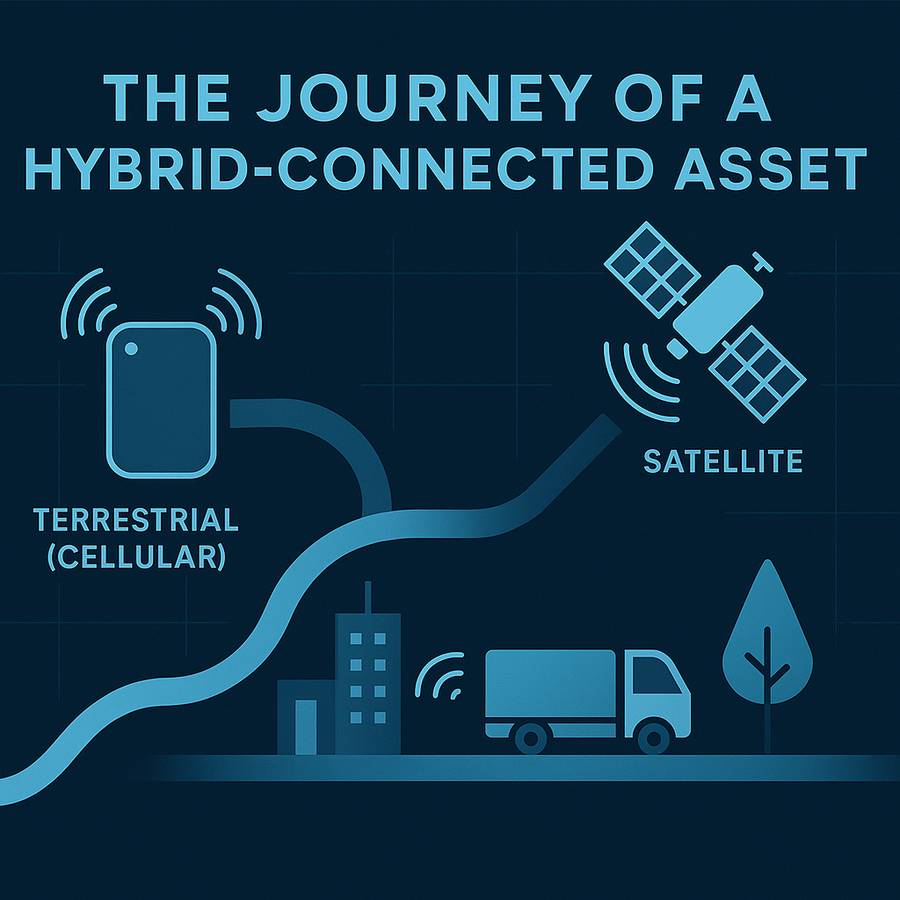

At the heart of this shift is hybridity. For a long time, satellite was treated as a bolt-on, a late-stage addendum for extreme use cases. Terrestrial connectivity was the main course; satellite was the emergency ration. The RM200M reverses that logic. Instead of forcing manufacturers to fuse two worlds together, Globalstar is offering a single module that simply expects an asset to wander in and out of coverage. The device behaves accordingly. It talks to cellular infrastructure when it’s available, then slips into Globalstar’s L- and S-band satellite network when the ground signal fades — without requiring a second SKU, a second certification path or a second power envelope.

This matters because the expectations around “connected assets” are rising sharply. Tracking is no longer just about scattered location pings. Companies want live health data, telemetry, environmental context, and increasingly the ability to send commands or adjust parameters remotely. None of that works if the device goes silent for long stretches. The emergence of relatively affordable, low-power satellite modules with two-way capability changes the equation. Assets that once vanished into coverage dead-zones can now remain part of the digital conversation.

Globalstar’s early adopter stories illustrate the trend. Lasso, which builds tracking systems for industries ranging from oil and gas to logistics and heavy equipment, emphasises how the RM200M’s simplified design has accelerated their development cycles and removed some of the friction that historically slowed hybrid deployments. Spotter International frames it even more directly: they needed uninterrupted connectivity for assets that simply refuse to stay within terrestrial range. The RM200M delivered that without forcing them into exotic engineering or high-cost integration.

The wider industry will recognise the significance. Large-scale asset operators want fewer surprises, fewer hardware variants and fewer reasons for a device to fall offline. They also want practical economics. And here the RM200M sits at an interesting intersection:

- it is low-power enough for long deployments,

- low-cost enough to deploy at volume,

- and two-way capable in a market where uplink-only modules dominate.

It is not alone — the hybrid shift is bigger than one company — but it is one of the clearest signs that this new architecture is maturing.

Of course, no module is perfect. Antenna design still requires care; battery budgets remain make-or-break for remote installations; certification in certain regions will always take longer than anyone hopes. The real point, though, is not that this module solves everything. It’s that the baseline expectations are finally changing. A decade ago, continuous asset visibility was a luxury reserved for large budgets and high-value equipment. Today, it is inching towards the default. The RM200M is evidence that manufacturers are responding not with niche hardware, but with mainstream modules intended for broad deployment.

The next phase of satellite IoT will be shaped less by constellation headlines and more by edge capabilities that quietly make outages disappear. When an asset can roam from highway to hinterland without losing contact, the operational model changes. Predictive maintenance becomes credible. Theft recovery becomes realistic. Traders in international volume products like sugar and coffee can predict quality and set future market values accordingly, retail vendors can have proof of origin, environmental and safety compliance become easier instead of harder. And businesses can make decisions based on real data rather than hope.

Globalstar’s RM200M is not the whole story — but it is a meaningful chapter in the narrative that SatelliteIoT.space has tracked since its inception. The industry is moving away from the era of acceptable blind spots. Hybrid connectivity, once exotic, is becoming ordinary. And the connected asset, wherever it travels, is increasingly expected to remain part of the conversation.